Defensive Driving Course NJ – Save on Insurance and Reduce Points

Enroll in a state-approved defensive driving course in NJ to lower your car insurance premiums and remove two points from your driving record. This online defensive driving course is recognized by the New Jersey Motor Vehicle Commission and follows National Safety Council guidelines.

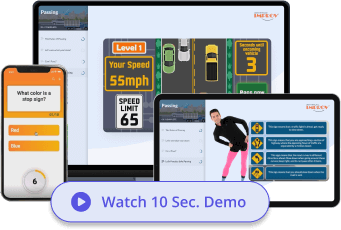

Online Defensive Driving Course – Complete at Your Own Pace

Our NJ defensive driving course allows you to complete the training at your own pace from the comfort of your home. There are no hidden fees, and upon course completion, you will receive a certificate that can be submitted to your insurance provider for discounts or to the NJ MVC for point reduction.

Benefits of the New Jersey Defensive Driving Course

- Reduce two points from your NJ driving record with online defensive driving course

- Qualify for an insurance discount with participating providers

- Complete the course entirely online

- Download your certificate of completion immediately

- Meet driver improvement program requirements

State-Approved NJ Defensive Driving Course

Our defensive driving techniques are designed to improve safe driving habits while helping drivers meet eligibility requirements for point reduction and insurance savings. This Jersey defensive driving course is ideal for probationary drivers, those with moving violations, or anyone looking to enhance their knowledge of NJ traffic laws.

How to Enroll in the Defensive Driving Course

Signing up is easy. Simply register online, complete the course at your own pace, and pass the final exam. Your course certificate will be available for immediate download upon successful completion.

Take the New Jersey defensive driving course once every three years to maintain a safe driver status and keep your NJ driving record in good standing.

Tags: online defensive driving course, online defensive driving course, defensive driving course, defensive driving, jersey defensive driving, driving record, online course, new jersey defensive driving, jersey motor vehicle commission, insurance discount, point reduction, probationary driver program, insurance company, insurance premiums, two point reduction, driver improvement course, jersey defensive driving, traffic violation, classroom course, final exam, new jersey mvc, course material. Live Chat

Live Chat

(200K+)

(200K+)