- Reckless driving: 20-25%

- Driving under the influence of alcohol or drugs (first offense): 18-21%

- Driving without a license: 16-18%

- Distracted driving (cell phone use, etc.): 15- 18%

- Driving over the speed limit (30 mph or more): 15%

- Not stopping at a stop sign: 15-16%

- Improper turning: 12- 14%

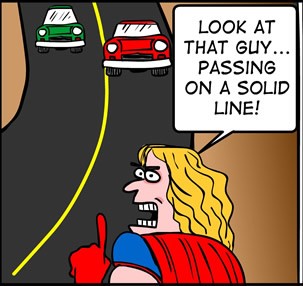

- Passing another vehicle: 14%

- Tailgating: 13%

- Not stopping or yielding the right-of-way: 9%

Take Advantage of Traffic School

When you get a traffic ticket, especially for a violation that falls into the top 10 category for insurance rate hikes, ask for traffic school. In many states, it also is reffered to as a defensive driving course but it is really the same thing. In most cases, you need to take care of your ticket within a few weeks to a few months. Once it’s on your driving record it stays there, so request traffic school within the required time period.

States like Arizona, California, Florida, and Texas offer state-wide traffic school programs. However, in the event that the state does not offer a traffic school program, many judges may allow you to complete traffic school online or in a classroom from a nationally accredited provider.

Other Options to Save on Your Auto Insurance

- Consolidate your auto and home insurance providers to receive a discount for having multiple policies.

- Ask your insurance agent if they offer a good student discount or an additional discount for taking a defensive driving course.

- Increase your comprehensive and collision deductibles to save up to 30%. If your car is not worth that much, you may even consider dropping these coverages.

- Lower coverage limits, if possible.

Live Chat

Live Chat